Top Five Things to Consider for Rogers Park Chicago Multifamily Real Estate in 2022

INTRODUCTION AND OVERVIEW

There are many neighborhoods to consider when looking to make a multifamily purchase in Chicago. Today, we wanted to showcase the top five things to consider when looking at multifamily real estate in Chicago’s far north side neighborhood, Rogers Park. If you have any questions or would like to learn more about the market, please don’t hesitate to reach out to our team for more information, and check out our active listings here.

1. NEIGHBORHOOD CHARACTERISTICS

According to the Chicago Metropolitan Agency for Planning Rogers Park Community Data Snapshot, multi-family housing makes up approximately 93% of the housing for Rogers Park with property types featuring 20 units or more representing the largest sub-type at 38.8%. Within those properties, studio and one-bedroom floorplans represent almost 50% of all unit types. Two-bedroom layouts are the next most common representing approx. 31.6% of all unit types.

Essex Insight: This unit mix is ideal for investors as studio, one- and two-bedroom apartment layouts are typically easier to rent than larger floorplans featuring three or more bedrooms.

2. RENT METRICS

Over the last 30+ years, Essex has collected data on multifamily properties located throughout the Chicagoland area. We have digitized thousands of property operating statements, rent rolls, and transaction sale metrics to create a robust database now capable of analyzing neighborhood trends.

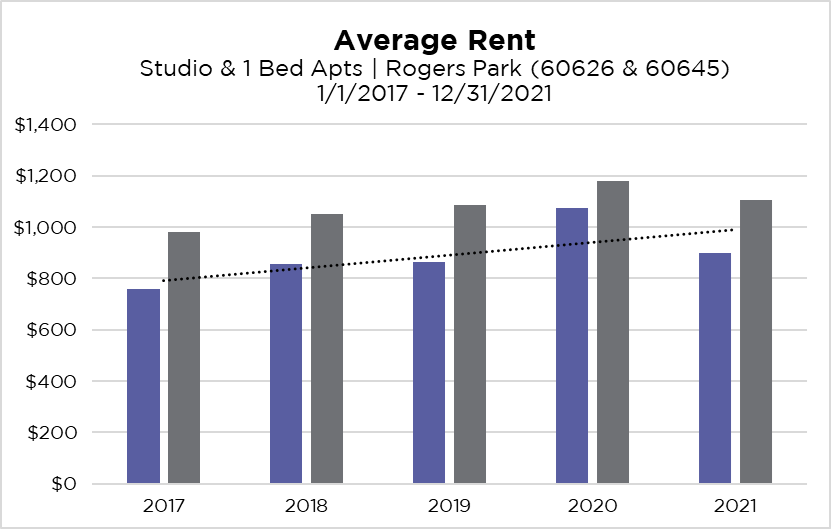

Using our proprietary rental comparable database, we have reviewed average rents and annual rent growth rates for studio and one-bedroom apartments in Rogers Park (zip codes 60626 and 60645). Our data shows that the average yearly non-compounding rental growth rate over the last five years is approximately 4% for studio apartments and 3% for one-bedroom apartments. The average studio rent over the last five years is approximately $891 per month while one-bedrooms are renting for an average of $1,081 per month.

It is important to note that while the average yearly non-compounding rental rate over the last five years shows growth, the average rent for studio and one-bedroom apartments in Rogers Park dipped slightly between 2020 and 2021¹ specifically, likely due to effects from the COVID-19 pandemic. As we continue to bounce back from the pandemic, we expect rents to do the same in 2022.

Essex Insight: Current rental rates, historical rent trends, and average annual change in rent are all important metrics that can help an investor understand a neighborhood market on a deeper level. Though rents dipped between 2020 and 2021¹, the 5-year average still reflects rent growth, suggesting the dip is likely to be attributed to the pandemic.

3. SALE METRICS

Going a bit deeper into our data for the Rogers Park market, we have found that in 2020 the average GRM² sat at 9.83³. In 2021, Essex brokers have facilitated the sale of 130 units across four apartment buildings throughout the Rogers Park neighborhood and the average GRM is 10.66³, which marks an increase of 8% from the average 2020 GRM.

4. UNIQUE OPPORTUNITIES

According to the Chicago Metropolitan Agency for Planning Rogers Park Community Data Snapshot, 96% of all housing located throughout Rogers Park was built before the year 2000 and, more specifically, almost 50% of that housing stock was built before 1940.

Essex Insight: Rogers Park is a great neighborhood for investors to find value-add opportunities because such a large portion of the multifamily housing stock features apartments with older finishes.

For example, in 2021, the Essex team facilitated the sale of 2020 W. Farwell Avenue, a 49-unit elevator building in Rogers Park. The property had been owned and operated by the same family for more than 50 years providing a new owner the opportunity to improve the physical condition of the units, increase rents, and streamline expenses. The apartments had dated finishes such as laminate countertops, white appliances, carpet throughout, and vintage bathrooms. The one-bedroom apartments at the time averaged approximately $929 per month in rent. The Essex team marketed this property as a value-add opportunity because after an in-depth comp analysis the team showed that renovated one-bedroom apartments in the same pocket of Rogers Park averaged approximately $1,200 per month in rent. Renters will typically pay a premium for high-end finishes like stainless steel appliances and quartz countertops, and by renovating the units at Farwell, the new owner will be able to add value to their investment.

5. REASONS TO INVEST IN ROGERS PARK

Case Study: 1426 W. Jonquil Terrace

We wanted to share more details about another recent Rogers Park transaction to further highlight some of the real reasons why investors love the area. In 2021, Essex facilitated the sale of 1426 W. Jonquil Terrace, a center entrance 6-flat located in East Rogers Park. This property had large apartment units with vintage finishes that had been well maintained by the same owner for over 35 years. These older spacious units in a building located just a few blocks from Lake Michigan enticed investors. An extensive marketing campaign by Essex resulted in 12 property tours and multiple offers in just two weeks. Based on the neighborhood housing data and our own brokerage experience, Rogers Park has a number of value-add opportunities just like this one. Investors seeking well preserved assets with vintage appeal will find opportunities here.

“1426 W. Jonquil Terrace was a very special property to work on as its vintage appeal has been well-preserved over the 30+ years the ownership entity has held this asset,” explains director Jacob Goldstein. He continued, “The new buyer is able to take advantage of the many value-add strategies this deal has to offer. Rents were significantly below market at the time of sale and the extremely large layouts offered investors the opportunity to add bedrooms, convert to condos, or renovate and bring rents to market level. The property was well received by the market and created a high volume of showings, which converted into a competitive bidding process within the first two weeks of marketing.”

Looking ahead, we believe that the Rogers Park multifamily market will continue to improve. If Rogers Park is a market that is of interest to you, we are here to help! Essex Realty Group has serviced the Chicagoland market for over 30 years and our agents would love to chat with you. We hope you enjoyed this blog post, if you’d like to check out any of our other active listings, please check them out here!

Footnotes:

- Our proprietary Rent Comp Database is updated through 12/31/2021

- GRM is defined as Gross Rent Multiplier and is calculated by dividing the Sale Price by Scheduled Gross Income

- For multifamily properties 10 units and up, that sold in Rogers Park for between $1M-40M