Why Chicago’s South Shore Real Estate Market Should Be On Your Radar in 2022

INTRODUCTION AND OVERVIEW

There are many neighborhoods to consider when looking to make a multifamily purchase in Chicago. Today, we wanted to highlight Chicago’s South Shore real estate market and touch on some reasons why we believe it should be on your radar as an investor. If you have any questions or would like to learn more about the market, please don’t hesitate to reach out to our team for more information, and check out our active listings.

NEIGHBORHOOD CHARACTERISTICS

South Shore is located approximately six miles south of the Chicago Loop along the shores of Lake Michigan. This culturally rich neighborhood is home to several attractions including Rainbow Beach and Rainbow Beach Park, the South Shore Cultural Center, and the Stony Island Arts Bank. Residents of South Shore have excellent access to public transit with five Metra Electric stops sprinkled throughout allowing for quick and easy access to downtown Chicago. Jackson Park, situated just north of South Shore, is the future home of the Barack Obama Presidential Center and current home of the Museum of Science and Industry, and the Jackson Park Golf Course.

According to the Chicago Metropolitan Agency for Planning South Shore Community Data Snapshot, of the occupied housing units in South Shore, approximately 78% are renter-occupied, and multi-family housing makes up approximately 86% of the housing stock.

Essex Insight: Metrics like these are encouraging to multifamily real estate investors as it suggests the demand for rental housing is high.

RENT METRICS

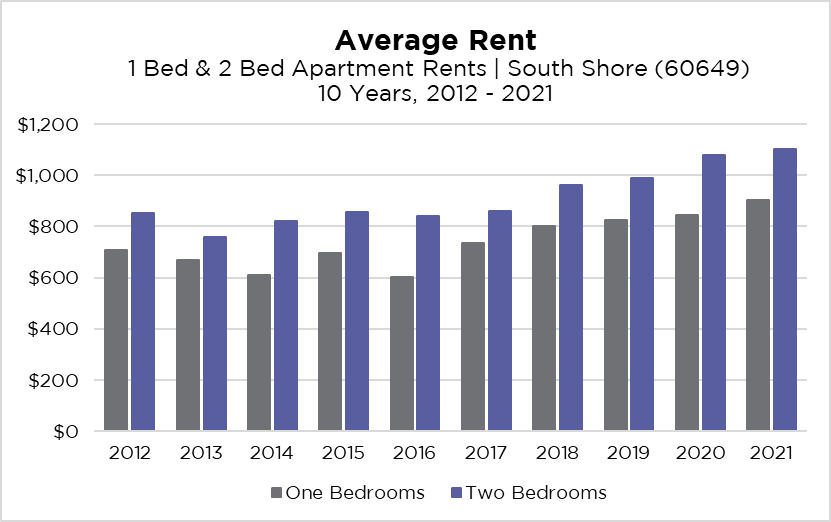

Over the last 30+ years, Essex has collected data on multifamily properties located throughout the Chicagoland area. We have digitized thousands of property operating statements, rent rolls, and transaction sale metrics to create a robust database now capable of analyzing neighborhood trends.

Using our proprietary rental comparable database, we have reviewed average rents and annual rent growth rates for one- and two-bedroom apartments in South Shore (zip code 60649) over a 10-year period. Our data shows that the average annual non-compounding rental growth rate over the last 10-years is approximately 4% for 1 Bed/1 Bath apartments and 3% for 2 Bed/1 Bath apartments.

SALE METRICS

Investors are drawn to multifamily and mixed-use investments located in South Shore for many reasons, but a big draw is the affordable purchase price-points. South Shore investments typically trade at a lower price-per-unit and at a higher cap rate than investment properties located on Chicago’s northside. For example, in 2021 the Essex South Side Team, led by director Brian Mond, sold four South Shore investment properties and the average cap rate for those four sales was approximately 9.37%.

The cap rate is the expected annual unlevered rate of return of an investment property and is a metric commonly used to measure and compare multifamily and mixed-use real estate. The cap rate is calculated by dividing the net operating income by the purchase price. When purchasing a property with a higher cap rate it means an investor is expected to earn more on their investment compared to a property with a lower cap rate.

Essex Case Study: 7517 S. Coles Avenue, a stately 43-unit courtyard building, sold in 2021 for $1,950,000 at a cap rate of 8.25%. This multifamily investment property is situated in a prime location within the South Shore neighborhood, just one block from Rainbow Beach and one block from the Windsor Park Metra Station.

BUYER PROFILE

Local and out-of-state investors alike are drawn to investment opportunities located in South Shore because the properties check a lot of the boxes investors are looking for:

- Access to great public transit

- Stately apartment buildings built to last with brick and stone masonry

- Affordable price points

- Value-add opportunities

- Great location near downtown Chicago and along the beautiful lakefront

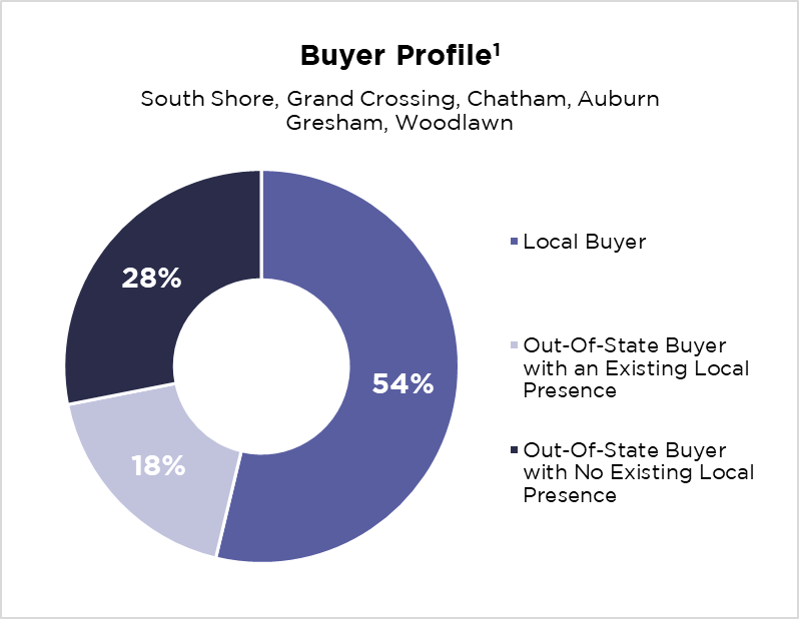

According to CoStar comps the buyer profile for South Side buyers breaks down into the following categories: 54% of buyers are local to Illinois, 18% are from out-of-state, but have an existing local portfolio at the time of purchase, while the remaining 28% are buyers from out-of-state with no existing Chicago-area portfolio at the time of purchase.

Essex Case Study: Essex recently sold 6720 S. Jeffery Boulevard, an 81-unit multifamily property located in Jackson Park Highlands, a sub pocket of South Shore. After an extensive marketing campaign resulting in seven offers to purchase the property, it ultimately sold to an out-of-state investor with an existing local presence.

“Local and out-of-state investors alike were drawn to this listing due to the unit count, ideal location, and value-add opportunity”

explained Brian Mond, Essex director and head of the South Side real estate team.

PUBLIC & PRIVATE INVESTMENT

INVEST South/West is an incredible initiative by the city of Chicago to funnel more than $750 million in public funding into 10 communities located across Chicago’s south and west side. Created in October 2019, INVEST South/West is a three-year program specifically geared towards enriching 12 commercial corridors within these communities. According to the city of Chicago, these commercial corridors were selected as they represent “the front doors to the neighborhood,” and re-activating these stretches will in turn benefit the neighborhoods.

The communities include: Auburn Gresham, Austin, Bronzeville, Greater Englewood, New City, North Lawndale, Humboldt Park, Greater Roseland, South Chicago, and South Shore.

Types of Approved Proposals: As an example, on January 31, 2022, the Lawndale Innovation Center proposal was approved. According to the website, “The Lawndale Innovation Center is a $38.4 million project led by 548 Development and Related Midwest proposed for Roosevelt Road and Kostner Avenue on the West Side of Chicago's largest piece of vacant land. The 20.8-acre development will include a 302,140-square-foot solar-powered industrial complex, a pair of community centers and public open space featuring public art. The project is expected to create approximately 700 permanent and temporary jobs.”

Essex Insight: According to Mond, “The South Shore neighborhood is one of the 10 communities selected as part of INVEST South/West, an initiative put forth by the city of Chicago to enrich and re-activate commercial corridors.” Asked about the impact of this program, Mond says, “It is an exciting time for residents and investors on Chicago’s south side! The City’s Planning Department has put forward proposals located in neighborhoods on the south side including INVEST South/West and the newly approved Obama Presidential Center. We are witnessing hyper-focused reinvestment in these neighborhoods, which will support local businesses and the residents that live in these neighborhoods.”

CONCLUSION

In conclusion, multifamily and mixed-use real estate investors should keep Chicago’s South Shore neighborhood on their radar for several reasons:

- The majority of residents are renters, and the majority of the housing stock is comprised of multi-family properties;

- The neighborhood is well-located, approximately six miles south of the Chicago Loop and along the shores of Lake Michigan, plus the neighborhood has great access to public transit;

- Rental rates have increased over time;

- Investment real estate in South Shore is more affordable than comparable properties located in north side neighborhoods providing investors with more value at the time of sale;

- South Shore is receiving public and private investment to help strengthen the commercial corridors in the neighborhood

We hope you enjoyed learning more about Chicago’s South Shore real estate market. If you have any questions or would like to learn more about the market, please don’t hesitate to reach out to our team for more information, and check out our active listings here.