Why Investors Should Consider Cook County’s Southwest Suburbs in 2022

An Analysis of Multifamily Investment Properties in Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth

Introduction and Overview:

The Chicago metropolitan area is a vast geographical area encompassing the city of Chicago and its surrounding suburbs. According to Wikipedia, there are 100 Chicagoland area suburbs that span 16 counties in three states, Illinois, Wisconsin, and Indiana. Today, we wanted to narrow down this vast market and highlight a cluster of five cities located in southwest Cook County: Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth. If you have any questions or would like to learn more about the market, please don’t hesitate to reach out to our team for more information, and check out our active listings HERE.

1. AREA CHARACTERISTICS

The data for each city below was gathered from the Chicago Metropolitan Agency for Planning Community Data Snapshot website.

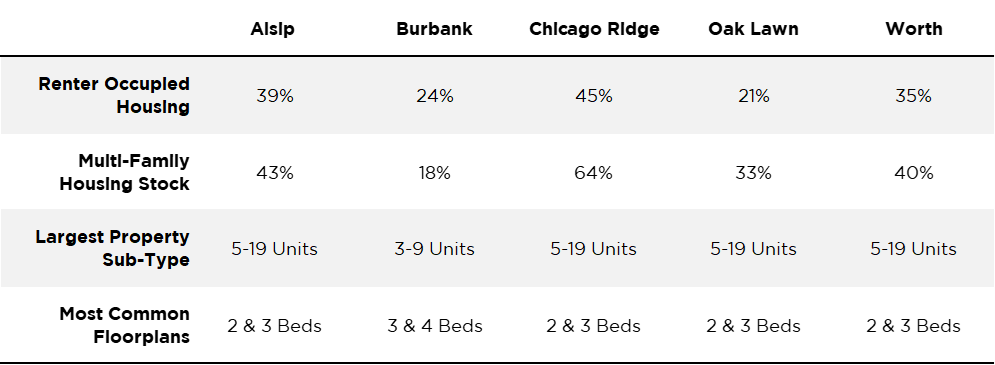

Alsip (1): Along with the village of Worth, Alsip borders the Little Calumet River. The two villages tend to be less transactional than their neighbors to the North – Chicago Ridge and Oak Lawn, however, recent sales have shown investors are willing to pay similar prices for multifamily real estate. Renter-occupied housing makes up approximately 39% of all occupied housing. Regarding specific housing type characteristics, multi-family housing makes up approximately 43% of the housing in Alsip with property types featuring 5-19 units representing the largest sub-type at 28%. Within the housing stock, three-bedroom floorplans represent approximately 40% of all unit types. Two-bedroom layouts are the next most common representing approx. 35% of all unit types.

Burbank (2): Located just south of Midway Airport and along the Southwest edge of Chicago is Burbank. The village itself was originally part of Lyons Township but in 1952 became part of Stickney Township. The area wasn’t officially incorporated into a city until 1970. Renter-occupied housing makes up approximately 24% of all occupied housing. Regarding specific housing type characteristics, multi-family housing makes up approximately 18% of the housing in Burbank with property types featuring 3-9 units representing the largest sub-type at 11%. Within the housing stock, three-bedroom floorplans represent approximately 53% of all unit types. Four-bedroom layouts are the next most common representing approx. 20% of all unit types.

Chicago Ridge (3): The village of Chicago Ridge consists of the largest number of 5-19-unit properties across the five cities. Many of them are concentrated close to major transit areas and consist of 6, 12, and 18-unit multifamily buildings largely built in the 60’s and 70’s. Due to the large multifamily housing stock available, Chicago Ridge tends to be one of the most transactional cities in the southwest suburbs every year. Renter-occupied housing makes up approximately 45% of all occupied housing. Within the housing stock, two-bedroom floorplans represent approximately 49% of all unit types. Three-bedroom layouts are the next most common representing approx. 27% of all unit types.

Oak Lawn (4): The largest of all the cities in the case study is the village of Oak Lawn. Located south of Burbank and southwest of Chicago, Oak Lawn encompasses of population of a little under 60,000 people. In 2002 downtown Oak Lawn (95th Street Corridor) was the target of a massive redevelopment bringing in several high-end condo and mixed-use developments. Oak Lawn is also home to Illinois’ fourth largest hospital – Advocate Christ Medical Center, a 788-bed teaching hospital located along the 95th Street corridor. Renter-occupied housing makes up approximately 21% of all occupied housing. Regarding specific housing type characteristics, multi-family housing makes up approximately 33% of the housing in Oak Lawn with property types featuring 5-19 units representing the largest sub-type at 19%. Within the housing stock, three-bedroom floorplans represent approximately 42% of all unit types. Two-bedroom layouts are the next most common representing approx. 30% of all unit types.

Worth (5):

The smallest of the five municipalities is the village of Worth. Over one third of the roughly 10,000 person population occupies a multifamily rental. While not as transactional as the other cities listed above, Worth continues to attract plenty of rental demand and investor attention anytime a property hits the market. This is likely due to the barrier of entry of investing into a smaller suburban city. Regarding specific housing type characteristics, multi-family housing makes up approximately 40% of the housing in Worth with property types featuring 5-19 units representing the largest sub-type at 33%. Within the housing stock, three-bedroom floorplans represent approximately 40% of all unit types. Two-bedroom layouts are the next most common representing approx. 37% of all unit types.

2. RENT METRICS

Over the last 30+ years, Essex has collected data on multifamily properties located throughout the Chicagoland area. We have digitized thousands of property operating statements, rent rolls, and transaction sale metrics to create a robust database now capable of analyzing neighborhood trends.

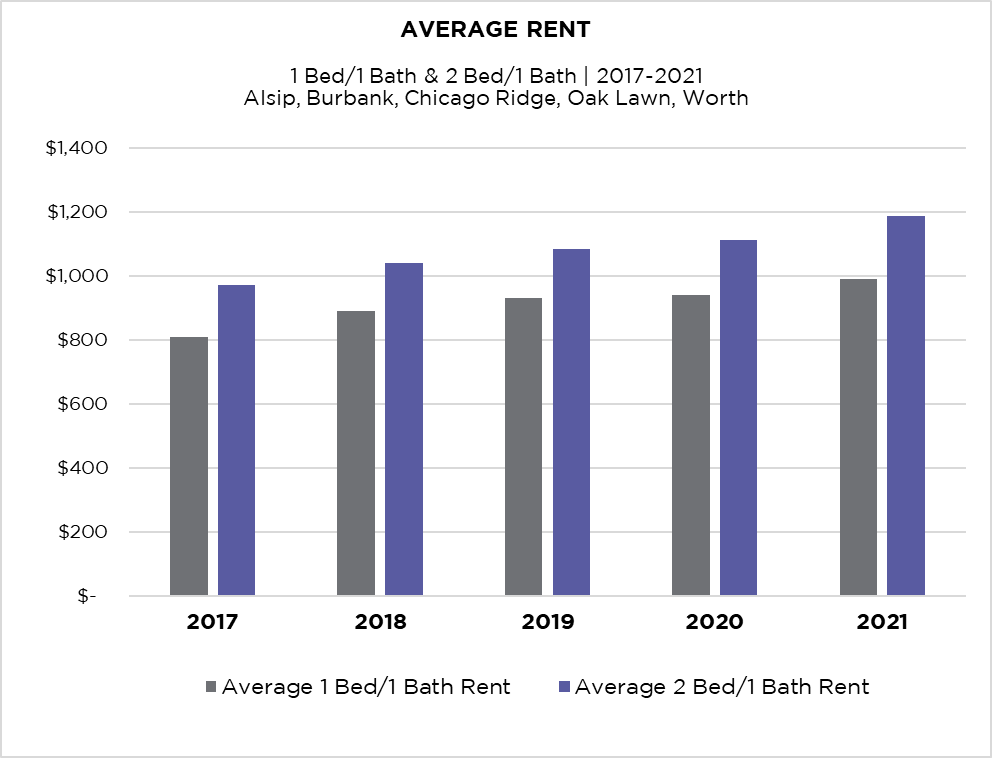

Using our proprietary rental comparable database (6), we have reviewed average rents and annual rent growth rates for 1 Bed/1 Bath and 2 Bed/1 Bath apartments in Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth. Our data shows that the average yearly non-compounding rental growth rate over the last five years is approximately 5% for both one- and two-bedroom apartments. The average 1 Bed/1 Bath rent over the last five years is approximately $912 per month while 2 Bed/1 Bath apartments are renting for an average of $1,078 per month.

Essex Insight: Current rental rates, historical rent trends, and average annual change in rent are all important metrics that can help an investor understand a neighborhood market on a deeper level.

3. SALE METRICS & BUYER TYPE

Investors are drawn to multifamily investment opportunities located in the southwest Cook County suburbs of Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth for many reasons including the affordable purchase price-points. For example, over the last three years Essex has sold seven multifamily properties totaling over $19 million in closed transactions and over 250 units. The average cap rate of those seven multifamily property transactions was approximately 7.26%.

The cap rate is the expected annual unlevered rate of return of an investment property and is a metric commonly used to measure and compare multifamily and mixed-use real estate. The cap rate is calculated by dividing the net operating income by the purchase price. When purchasing a property with a higher cap rate it means an investor is expected to earn more on their investment compared to a property with a lower cap rate.

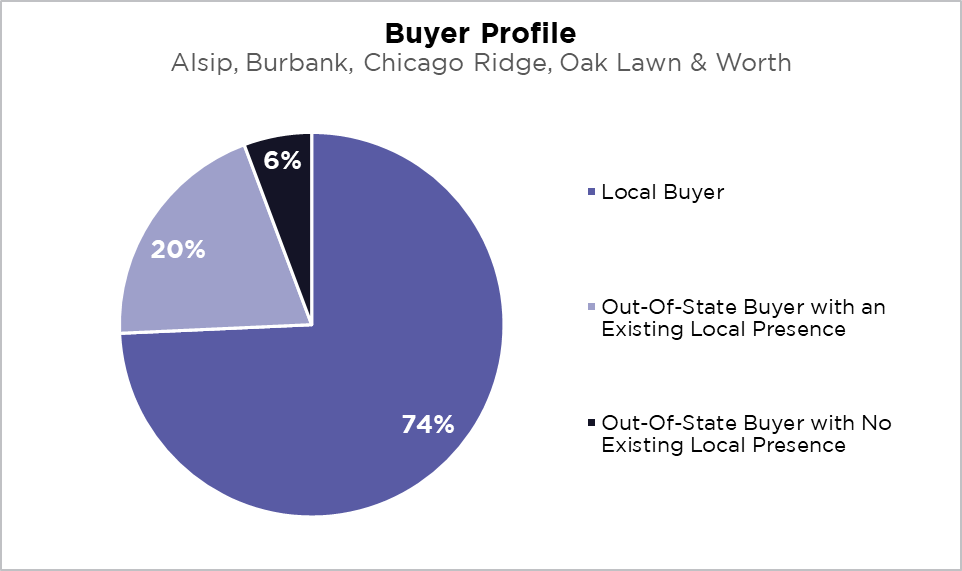

According to CoStar comps the buyer profile for buyers of multifamily properties in Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth breaks down into the following categories: 74% of buyers are local to Illinois, 20% are from out-of-state, but had an existing local portfolio at the time of purchase, while the remaining 6% are buyers from out-of-state with no existing Chicago-area portfolio at the time of purchase.

4. UNIQUE OPPORTUNITIES

According to the Chicago Metropolitan Agency for Planning Community Data Snapshot for Alsip, Burbank, Chicago Ridge, Oak Lawn and Worth, on average between the five cities, approximately 95% of all housing located in these cities was built before the year 2000.

Essex Insight: This pocket of southwest Cook County cities is great for investors to find value-add opportunities because such a large portion of the multifamily housing stock features apartments with older finishes.

For example, in 2020, the Essex team facilitated the sale of a 15-unit multifamily property located in Burbank, IL. The property had been owned and operated by the same family for more than 40 years providing a new owner the opportunity to improve the physical condition of the units, increase rents, and streamline expenses. The apartments had dated finishes such as laminate countertops, white appliances, carpet throughout, and vintage bathrooms. The one-bedroom apartments at the time averaged approximately $716 per month in rent, while the two-bedroom apartments averaged $822. The Essex team marketed this property as a value-add opportunity because after an in-depth comp analysis the team showed that renovated one-bedroom apartments in the same pocket averaged significantly more per month in rent. Over the last two years the new owners have renovated the apartment units to include new stainless steel kitchen appliances, new kitchen cabinets, new finishes in the bathrooms, and refinished hardwood floors. Today the one-bedrooms are now averaging $1,050 per month in rent and the two-bedrooms average $1,295 per month.

According to Derek Kaptanoglu, the broker on the 2020 sale, “There are a limited number of updated rental units across all of the southwest suburban rental markets and the new owners were able to capitalize on the demand. By renovating the apartment units the owner was able to increase rents by over $300 per month for both the one- and two-bedroom apartment floorplans. Renters are willing to pay a premium for high-end updated suburban rental products which is difficult to find in many of the older 1960’s and 70’s properties which encapsulate a large majority of the available housing stock.”

5. REASONS TO INVEST IN SOUTHWEST COOK COUNTY

Case Study: 18-Unit Multifamily Property in Worth, IL

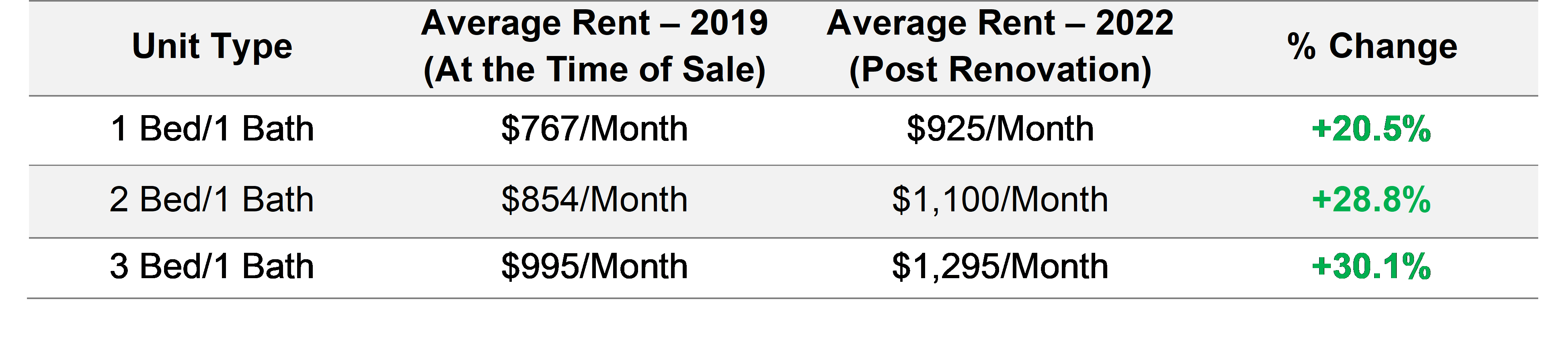

We wanted to share more details about another recent transaction to further highlight some of the real reasons why investors love the area. In 2019, Essex facilitated the sale of an 18-unit multifamily property located in Worth, IL. The unit mix was comprised of a mix of one-, two- and three-bedroom apartment floorplans and the unit finishes were dated. Investors were drawn to this value-add opportunity resulting in the property going under contract after just two weeks on the market. Over the last three years the new owner has renovated the apartment units and has successfully been able to lease the renovated units for approximately $250 more in rent per month, see detailed table below:

“This is another example of what updating an older suburban multifamily property can do for investors. Well-located suburban assets continue to bring in large numbers of renters seeking more modernized finishes and amenities.”

Derek Kaptanoglu

Looking ahead, we believe that the southwest Cook County multifamily market will continue to improve. If Alsip, Burbank, Chicago Ridge, Oak Lawn or Worth are markets of interest to you, we are here to help! Essex Realty Group has serviced the Chicagoland market for over 30 years and our agents would love to chat with you. We hope you enjoyed this blog post, if you’d like to check out any of our other active listings, please check them out HERE!

Footnotes:

- CMAP Oak Lawn - https://www.cmap.illinois.gov/documents/10180/102881/Oak+Lawn.pdf

- CMAP Alsip - https://www.cmap.illinois.gov/documents/10180/102881/Alsip.pdf

- CMAP Burbank - https://www.cmap.illinois.gov/documents/10180/102881/Burbank.pdf

- CMAP Chicago Ridge - https://www.cmap.illinois.gov/documents/10180/102881/Chicago+Ridge.pdf

- CMAP Worth - https://www.cmap.illinois.gov/documents/10180/102881/Worth.pdf

- Our proprietary Rent Comp Database is updated through 12/31/2021